The Inaugural Survey of Infusion Copay Cards

The Inaugural Survey of Copay Manufacturer Programs

Q Consulting Support Services conducted a survey of infusion center staff who work regularly with copay programs and after tabulating all of the responses, have come up with the Top-10 Manufacturer Copay Assistance Programs based on five criteria.

The easy winner was Jannsen Carepath, who had the top score in all categories except for one. At the bottom was Zoladex, who failed on most levels, but was particularly weak when it came to the ability to secure payments.

1. Ease of Copay Card Enrolment

The winners of this segment all had two key ingredients

- Online ability to submit information for approval – particularly via a portal

- Immediate Notification of approval

Most of the manufacturers have a portal program or other online programs.

The two programs that performed poorly in this category was Pfizer enCompass, which requires a paper submission via fax and was described as ‘frustrating’ to almost all respondents. The Merck Access Program was also at the bottom of this group with respondents noting that ‘it can take as long as a week to receive notification of approval into the program’.

Several comments were also made regarding Amgen’s First Step program which received comments like “a great online service with immediate notification of approval” but the ‘requirement of a social security number make it difficult for staff to easily sign up the patient’ as this information isn’t something that always sits at their fingertips.

2. Ease of Copay Claim Submission

A portal is the preferred method of submitting the Explanation of Benefits, and other items that copay manufacturer programs request. Janssen is the clear winner and the only one to score a perfect score for this category.

The bottom of the pile for this category was Zoladex and most comments revolved around how many times a fax needed to be submitted – “in multiple follow-up calls to check on status, they always tell us that the full fax wasn’t received and another one needs to be resubmitted”.

Another weak performer in this group was Coherus Complete whose fax number is frequently busy and requires multiple attempts before a fax makes it through. It took one respondent 2-days of trying before the fax was finally accepted

3. Time to Copay Approval

With the exception of Zoladex (which can take over a month), most copay manufacturer programs have between a 3 and 7-day approval timeframe. Again, portals are preferred as the user can check on the status of the approval without having to call for status updates.

4. Notification of Copay Payment Approval

This is where the portal was strong again – being notified immediately via the portal was the preferred method. However, Amgen FirstStep scored high marks, despite receiving notifications via fax, because the notification includes the details of the payment and whether it is being made by check (for which they include the check number) or copay card (for which they include the credit card number and CVC#.)

Many of the others really require constant follow-up for approval details, which was a big frustration to the survey respondents.

5. Customer Service

In general, every copay card assistance program has excellent customer service, with representatives that are very knowledgeable and helpful. Entyvio and Janssen lose one star here because the representatives have struggled occasionally with questions – particularly as it relates to the portal.

About Q Consulting Support Services

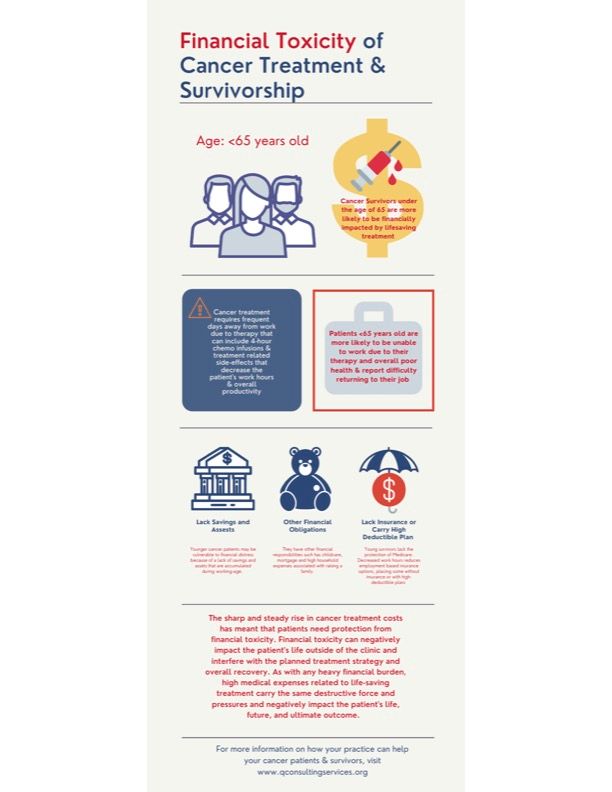

Copay Assistance Programs lessen the patient’s financial burden, making it easier for them to obtain their prescription and ensure that the appropriate treatment is attainable.

Q Consulting Support Services specializes in the management of Copay Card programs. Our dedicated staff partners with clients ranging from small oncology practices to the country’s largest healthcare systems. Our Support Service team enrolls the patient into the Copay Card Program, monitors and submits EOBs with patient out-of-pocket expenses, and follows up on any denials to ensure payment is received promptly. Ultimately, increasing patient satisfaction and reducing the financial burden on the provider’s office or facility by guaranteeing patient out-of-pocket expenses are obtained, which reduces bad debt and increases revenue.